“Life is like skiing. Just like skiing, the goal is not to get to the bottom of the hill. It’s to have a bunch of good runs before the sun sets.” – Seth Godin, American Author.

Before we begin – alongside Rod Turner I’m running a Property Business Workshop this week in London on Thursday (25th January). We are covering a wide range of topics – all the way from what a great investment looks like, to how to operate more than one company, why you would do that, how you might structure it, all the way down to a whole host of productivity hacks and general “January fitness” activities for your business(es). The last few tickets are still available here: https://bit.ly/PropertyBusinessWorkshop – if you can’t make it, but you can think of someone who might want to come along, could you do us a favour and send them the link?

Into the breach, dear friends. Big macro this week, and potentially big implications on the back of it. One of the very regular issues with the mainstream these days is that they cry wolf, or perhaps more accurately “crisis” 3-4 times per year at least (then blown up by tens of thousands of articles and online entries). I asked Google’s Bard this question:

“How many times was the word “crisis” mentioned in articles on the internet published in 2023 in a UK context?”

And – as you do with the large language models – I got a long answer. But if I “just” paste the top bit, these will ring a bell:

- The ongoing COVID-19 pandemic, which continued to disrupt lives and economies around the world.

- The war in Ukraine, which caused a humanitarian crisis and had a significant impact on the global economy.

- The cost-of-living crisis, which saw many people struggling to afford basic necessities due to rising inflation.

- The climate crisis, which continued to pose a major threat to the planet, with extreme weather events becoming more common.

I was going to challenge the top one for a start – thought we were more dealing with the after-effects, but apparently the WHO didn’t move from their top level of alert until 4th May 2023 (I was stunned to discover that, but time and memory play tricks on you, don’t they?)

These are not all cries of wolf, of course – but then other issues that are not immediately labelled a crisis are, by sensible brains, filed at the back of the “importance” pile, aren’t they? Whereas a much more measured approach would allow room to discover and discuss the important events happening in real time, with (ideally) some idea on how to manage the risks around them, actions to take now before those options go away, etc. etc.

You’ll (hopefully) recognise that that’s exactly what the Supplement tries to do, and see the gap that it is attempting to fill in the market. For free. Every Sunday. I strongly suspect that that gap will just continue getting wider, and I obviously can’t stem the tide alone – although, as I’ve said before, in the absence of a significant nuclear event in or around Solihull, I’ll be trying while there is breath in my body.

Into the macro – and as I alluded to, there are some significant consensus misses, and it was an uncomfortable week in general. You have to take the rough with the smooth – and this week was one of those – the worst of all worlds (although only a sprinkling of most of it), to an extent – but the end of none, and just another brick in the wall. There’s been triumphant weeks in the macro numbers of late – and this just wasn’t one of them.

Why not? Well, of the 25 widely published macroeconomic metrics (and a few more that I hunt down individually for various reasons), I am still going to limit myself to four. The labour market (I might have cheated there, as I will discuss more than one metric in that context, but who is counting?), inflation (and yes, that discussion will have various shades/flavours….), the RICS house price balance and retail sales. I’m having the bond yields as a freebie, since I do still have to talk about those every week because of their significant relevance and also continued volatility.

So – the labour market. I’ve said before – ALL the headlines get used up on unemployment, when really we should look at the entire makeup of that pool – the unemployed, the employed, and the “economically inactive” (before you think that might be a lovely place to be, most of the new entrants in that pool at the moment are there on the basis of long-term sickness!)

The pool in December’s “preliminary” figures for the quarter ending November 2023 looks like: Unemployment 4.2% (unchanged), Inactivity rate 20.8% (down 0.1%), Employed 75.8% (up 0.1%). 4.2% is low in any mature developed economy, 20.8% is still about 50-60 basis points higher than it was before the pandemic (depending on when you start measuring, the low is about 20.2%), and 76.6% was the previous high for the employment rate too (so that’s about 80 basis points off it’s best level yet or it’s “pandemic unaffected” level.

This goes much wider at the moment of course – concerns over wage-price spirals haven’t been mentioned for a while as the 3-month to November number continues to come down. Now down to 6.5% – which historically is very high of course – the last time it was lower, though, was August 2022. The recent high was 8.5% in quarter-end July 2023. It is likely obvious that 3-month inflation was lower, and so wages are moving forward in real terms at the moment.

Job vacancies are also important – down to 934k, which continues the downward trend – but still with a high of 865k before the pandemic, this is still not problematic territory (it has dropped from 1.3m, but of course one of the mitigating factors has been a gigantic amount of net migration). Recent chatter around profit warnings from big recruitment firms have a number of reasons behind them though – employees preferring a safer option of staying put at the moment in the expectation of job cuts being one. Hiring freezes are of course cited as well.

“Only” 69,000 working days were lost in November thanks to labour disputes – but again, the number is moving downwards and in the right direction here. There is one more sentence in the full ONS report which is worthy of highlighting, though:

“The estimate of payrolled employees in the UK for December 2023 decreased by 24,000 on the revised November 2023 figure to 30.2 million. The December 2023 estimate should be treated as a provisional estimate and is likely to be revised when more data are received next month.” It struck me as worthy of comment – because, upon checking, the typical direction in November is as you would expect – it moves upwards, not downwards. However, it might simply be that more were employed on a self-employed or “gig” style basis than has been the case in recent years…..but December’s figures do NOT look anywhere near as good on the basis of this statement (bearing in mind the other figures are all referring to the quarter ending November 2023). Is the canary in the coal mine starting to sing here – one month is not enough to say for sure – and the weather may well have had an impact in terms of floods changing priorities for many (rather than snow stopping people from going to the shops, for example!)

Enough – what looks like a bad December has not yet filtered into the labour market figures, and we will need to wait another month for the official December figs. Onto inflation. Wednesday opened with a “surprise” tick back up in inflation – a surprise to some, the consensus was down 0.1% to 3.8% rather than up 0.1% to 4% – not a massive miss to the upside, but the psychological impact of the move being upwards rather than downwards shouldn’t be underestimated.

This is, of course, “only” CPI. The ONS prefers CPIH to adjust any figures (such as average earnings) and for good reason – it at least attempts to capture housing costs, even though the methodology for owner occupiers is questionable. It’s a pretty good proxy for renters. It’s incredibly relevant in our industry at the moment, although it is widely accepted that it understates the cost for a large proportion, and therefore should be higher than it is. It is something I have to regularly remember when I look at the real/adjusted real figures for various metrics! I tend to give CPIH in its current form a wide berth for this reason, but the metric is the best that we have until the ONS comes up with a better methodology. CPIH held at 4.2% month-on-month – most know that rents are moving faster than this, and are likely more of the percentage share of a renter’s income than the 0.2% premium above CPI currently suggests (although rents don’t move in December aside from downwards, because demand dies off, so that’s potentially a moot point – but it is an evergreen one)

Regular readers will know that I like core inflation as a better measure of real underlying inflation in the economy, and a six-month “calm” water was broken by a 0.6% increase month-on-month, and a print of 5.1% for core (which was the same as November, but again, 0.2% above the consensus) is still concerning. The 6-monthly number, annualised, is back to 3.03% which is not a terrible stab for the current prevailing inflation rate, even with a backdrop of collapsed retail sales. You’ll note this is still well above the 2% target, but also well in my “comfortable” range that the Government secretly really enjoys, especially with frozen tax thresholds.

Services inflation, and it still drives me wild that you have to dig really deep to find mentions of this, in spite of its role in making up 47% of the headline CPI number. A tick back upwards last month to 6.4% – I see no world in which this doesn’t hold up in the face of 9.8% minimum wage rises in April, and that’s why I am left scratching my head in the face of some of the large forecasters inflation forecasts (not for the first time, you will note).

Here’s where I think they are coming from. Largely, they are quite lazy. There is (currently, at best guess) an estimate that the energy price cap will come down by 14% in April 2024 (it did tick up 5% at the start of this month, so that isn’t the drop that people might want). That has to help with energy bills forming 6-10% of the average household’s bills (and a shade more when it is -7 outside, etc. – although the arctic blast looks to have blasted off now, looking at the long range forecasts). That in itself (at 8% of a basket) accounts for 0.08 * -0.14 = -1.12% drop in inflation. But – in fact – it is more than that, because last April prices were still very high – so beware the base effect. This has been a big old Covid hangover that I’ve spoken about several times – remember the figure is measuring against the figures from 12 months ago, and in April 2023 it would be fair to say the cost of living crisis was actually a) real and b) at its height, although heating could be switched off. Just that month dropping out of the figures makes a massive difference.

Energy is of course one (large) component but what about these wage increases and services inflation still storming forward? How does this equate to sustained 2% inflation and below – which is where pretty much all the large forecasters are now at from May onwards this year. It will need a continued demand collapse from here (not just trusting December’s figures). We’ve already seen mistakes recently from taking 2 months’ figures as a trend in spite of my warnings (inflation), and there look to be a lot more on these forecasts.

So – we could easily see Jan inflation up when we get the figures, and easily see a big drop in April. We need to largely ignore those and won’t learn too much until May’s figures are out (in June) I’m afraid. You see why core, especially over shorter periods, remains my “friend” at this point I hope. To round off the “prices” discussion, RPI also beat the consensus by 0.1% and remains at 5.2%, down from 5.3% in November.

Onto the RICS house price balance, and the news was received very positively for a print of -30. So we still have nearly 2 surveyors suggesting prices are falling in the coming months versus one saying they are rising – but the -30 was above the consensus of -34 and a vast improvement on the -41 from November – and also, the best print since September 2022 (before you-know-what-vegetable happened). This was very much before the very positive moves downwards in mortgage rates at the start of January, so expect a better print again when we get the Jan figures next month, although yields are showing some signs of stubbornness, I’m afraid.

On a “normal” week – or perhaps I should say, if the bond market was easy to predict – which it really isn’t, otherwise I’d be very wealthy indeed given the liquidity in it – then a week when the retail sales figures are released and words like “collapse” are used, you’d expect yields to drop. Why? It is the indicator of an incoming recession. However, with inflation being stubborn, this reinforces a “stronger for longer” narrative with interest rates, which would affect yields to the upside. If those moves had happened when those relevant figures were released – then it would be easier to stomach – but they didn’t. Instead, yields pretty much held when the inflation numbers came out, and then went UP when the retail figures were released. We do have to remember, there are international events that also have relevance to our bond markets – and yields have looked stubborn in the US this week as well, and you have Davos (the World Economic Forum annual conference) happening at the same time as well, where occasionally someone comes onto an interview and makes a comment that moves the markets. Always beware when the yields move in the opposite way to that you would expect, especially when that move goes against you.

Or – put it into context. The 5-year gilt opened the week at 3.58% yield and closed at 3.74% yield. 16 basis points. Nothing to really write home about. 44 basis points above “Xmas week” where a lot of the current mortgage products were set – nearly half a percent – which is why mortgage products after the most recent cuts look like extremely good value right now. The swaps also have moved less – closing at 3.70% (perfectly possible for them to be below the gilt rate, and speaks to supply and demand in the swaps market) – which is far less of a premium over one month ago, where the last pre-xmas swaps were trading at 3.54%, meaning that the lenders are not too worried at all.

5.25% no fee 5-year limited company products, side-by-side with this (currently available at time of writing) look very fair in comparison – those lenders have got to try and make a profit, after all.

Put it into further context. My trading range for this year I defined as a pretty tight 3.5 – 4% for the 5-year gilt. Until something material changes, I’m sticking with that, and we are just right at the midpoint of my range. The anomaly remains the pricing in December, but that does appear to have been ironed out. Just a case of keeping calm, and carrying on.

Back to the retail sales figures. I’ve been reaching over to US figures quite regularly in recent times because I often say they are “ahead” of us in this cycle. They tend to take their medicine faster than we do on this side of the pond. When I saw the retail sales print on Friday – which was -3.2% month on month, versus a consensus of -0.5% – that was the first place I went. The US has, thus far in this cycle, only seen drops of 1.5% or thereabouts month on month, and usually either bookended by a great month the month before, or a quick recovery back upwards the month after.

Department stores took a beating with sales down 7.1% month-on-month. Black Friday was “blamed” – obviously, it cannibalises trade and it makes sense that savvy consumers during a cost-of-living crisis would front-load Christmas presents when the opportunity arose – it appears they did just that. That was the mainstream reasoning. We did also have some pretty bad weather – 3 named storms, although November had two and had printed +1.4%, the best print since April 2020 – so again, context helps. It’s still a big downside miss though.

The best framing is looking at the retail sales year-on-year, this terrible December number meant -2.4%, which is still a vastly superior print compared to everything since April 2022 and the cost of living crisis really started to kick off with the price cap really losing its impact in the domestic energy market. People have just had to spend less and retailers have taken it hardest, so this -2.4% will be a disappointment to them but it is the story of the past couple of years.

So – no recession incoming, in spite of the headlines? No real reason to see it any more than in the past couple of years in the very near future. The mighty meatiest macro week of the year has been dealt with, and we still appear to be solvent and not on an immediate road to ruin, in spite of the lukewarm efforts of our current great leaders (soon to be surpassed by the efforts of our next great leaders). Thank goodness once again that the economy just goes ahead and gets on with it. It looks like unemployment will tick up, that’s really what all the negative recruitment chatter means – but I haven’t seen many forecasts that see unemployment under 4.5% in 2024 and I do (for once) agree with that – the job trend is downwards and all the cost pressures are there to create some cuts, certainly in the listed companies while the SMEs just battle with reality.

That leaves us with a sliver of room for a deep dive. Due to the excessive macro meat I will limit this to a summary of one of my recent hobby-horses – the real house price in the UK, and the reality around affordability, intermingling the most recent data from UK Finance around mortgage lending too, which I have not yet incorporated since it was released last month.

So – regular readers and listeners will know that for the past 6 months I’ve been squawking, to anyone that will listen, about the fact that house prices look good value right now. I’ve found some (not many, but a few) allies in recent times on this cause, because the argument is actually very solid. That trend has, of course, continued throughout 2023.

We are now 15.7% off the most recent peak of real house prices in Q1 2022 – a considerable adjustment in under two years. 22.9% below Q3 2007 – although, arguably, that’s a good job since loosely underwritten credit and overleverage obviously fueled that market so much (whereas Q1 2022’s was more fueled by cheap money of course).

Houses are cheaper in real terms than since Q3 2013, when adjusted by RPI. Weekly earnings are, at the moment, moving upwards in real terms (even when adjusted by RPI) and houses continue to get cheaper (and will definitely continue to do so for Q1 2024 at the very least, with Q2 2024 looking like another banker to see prices come down in RPI-adjusted terms) – perhaps it will change in Q3, but these figures tell a completely different story to the standardised media narrative.

Rent, however, is still outpacing RPI AND wage growth at this time, although affordability continues to look like it has room to grow. I don’t have immediate concerns about this in the more provincial markets – in inner London, I’ve been concerned about it for many years!

That leaves the mortgage side of the equation. Q3 2023’s data (the recent release, this stuff is months behind I’m afraid) indicates that the pace of increasing arrears has slowed. Gross mortgage advances increased quarter on quarter for the first time since Q3 2022 – a meaningful quarter-on-quarter rise too, up 18.6%. New mortgage commitments, however, moved right downwards – because this was the quarter with the nastiest rates of all of last year as far as mortgages were concerned, so this is no surprise.

Gross mortgage advances for BTL are always where my eyes go when I look at this report though, of course. They were down through the floor at 7.5%, the lowest print since Q3 2010, and nearly 50% down from the typical trading range in a “normal” market. That speaks to the “new supply” issue in the current rental market quite dramatically.

1.14% of loans have an element of arrears – whilst this is the highest since Q2 2017, it remains low in a historical context, particularly in times of stress – the numbers in and around 2008 were far higher.

Pleasing to see for incumbents in the market. Unsurprising for many who struggled to get deals to stack in 2023 at the height of the highest interest costs in July/August. What’s the biggest takeaway though – these units, some of which would be refurbed etc, will have come online in recent months, and the new supply coming looks the same or even lower in terms of mortgages agreed in Q3 2023. Rent rises aren’t calming down too much at any particular point I can see, just yet.

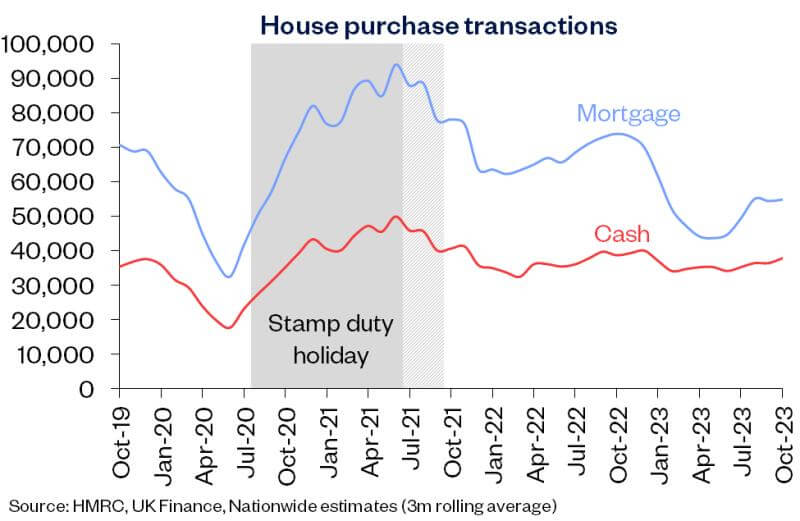

This week’s graph is a little more “real time” and shows the real extent of that mortgage “wobble” compared to when money was much cheaper in recent times. Look how steady those cash buyers look, though – hardly the sign of a terribly volatile market, just one being affected by the sweeping changes in the cost of borrowing!

Congratulations as always for getting to the end – don’t forget the Property Business Workshop on Thursday 25th January – you can still get a ticket for yourself, or anyone you know who might want one, here: bit.ly/PropertyBusinessWorkshop. You know the one remaining sentence – Keep Calm and Carry On!

Adam Lawrence