“Some people expect too much from others and too little of themselves.” – Christy Ann Martine, Canadian author

Before we begin – Rod Turner and I ran a Property Business Workshop last week in London. We covered a wide range of topics – all the way from what a great investment looks like, to how to operate more than one company, why you would do that, how you might structure it, all the way down to a whole host of productivity hacks and general “January fitness” activities for your business(es). We enjoyed it, got some great feedback, and met some great people too. We are going to run another one with fresh content including due diligence (both on business partners and with a view to lending money), joint ventures, mergers and acquisitions and some accompanying case studies on some easy (and more complex) deals that we’ve done. The tickets for the next one are here https://bit.ly/pbwtwo – the date for that one is Wednesday 24th April, and there’s a discount for the early birds so don’t be shy………

It’s hard not to get tunnel vision in a week where there is a Bank of England monetary policy committee meeting – and there’s a decent slice on what the Bank said, and did, and also what they didn’t say and do, later in this week’s efforts, but as a starter (or four) for 10 I’m going to talk about mortgage approvals and lending, the money supply, the Nationwide House Price Index, and – you guessed it – the bond and swap yields.

Mortgage approvals first of all (and consumer credit wrapped in). Consumers were less credit-hungry than expected in December – it did seem from the overall figures that firstly people front-loaded purchases on Black Friday, and there’s also speculation that the massively-growing new version of the “never never”, “Buy now pay later”, had some suppression effect on the figures as November boomed on the back of it, but people pay out of their pockets for the next 3 months (since that’s what keeps BNPL outside of the consumer credit act agreements and the likes, and keeps your BNPL on your credit card statements but outside of your credit rating – although it does, of course, count towards utilisation percentages and things like that).

Also – perhaps, in real time (and the figures lag a lot, so I have to speculate), people are still saving, expecting the worst, bearing the scars of the pandemic, or making that classic mistake of listening too closely to the mainstream media. Consumers can’t be berated for saving, though, and indeed had they chosen to save more rather than consume more post-pandemic, the inflation situation wouldn’t have been as bad as it was.

Mortgage approvals for December 2023 were up on November’s numbers – just – but didn’t hit the forecasted numbers. I was a little less bullish than the forecasters here – we have had low numbers ever since credit has been particularly expensive, but the forecasters seem to have forgotten just how high rates were as recently as December – the “decent” cuts including those that crossed the psychological threshold of 4% in the owner occupier market only happened in the first week of January. Next month’s numbers I expect to be ahead of consensus – although it isn’t like there’s a sudden rush into buy-to-let, just an improvement on the previous cost of borrowing! The again-psychological target of 50k was breached, just, but missed the consensus forecast by 4% or so. 50k is great (at the moment) but in a normal time, in a functioning market, you’d expect more like 65k so that really should be our yardstick rather than arbitrary numbers. Psychology matters though.

Then onto the money supply. This shines yet one more light onto that ongoing inflation debate. The chat is now that inflation will not only flatline, but even go negative this year (Capital Economics). I had my annual coronary that seems to recur when the forecasts start to make these great pronouncements on inflation. A quick look in their crack pipes, to see what they are smoking. Here’s the thrust of my argument:

- Energy prices up in Jan, which won’t help us kick off 2024 on a positive note

- Ongoing oil wobbles that are seeing breakouts to the upside, although currently under control – things ever hotter in the middle east from an international perspective

- Rerouting of ships – not a huge part of CPI, but not a help either – it changes expectations to the upside

- Wages, wages and wages – the insane premium above where inflation is likely to be in April, surely calculated way back when to simply buy some votes, is seriously risky business – remember 9.8% min wage rise coming

- The secular Covid hangover – “team transitory” surely aren’t stupid enough to believe they can claim it was ALL transitory inflation and just “took a bit longer than expected” to work through the system? Surely?

- Services inflation – 47% of CPI – still 6.4%

- Core inflation – still 5.1% and over 3% if you annualise the last 6 months figure

- Demand still relatively healthy in the economy

- Cross the Rubicon to the other “school” of economics (I went to the Economics school of hard knocks, not a converted Keynesian or Monetarist by any means) – the money supply…..

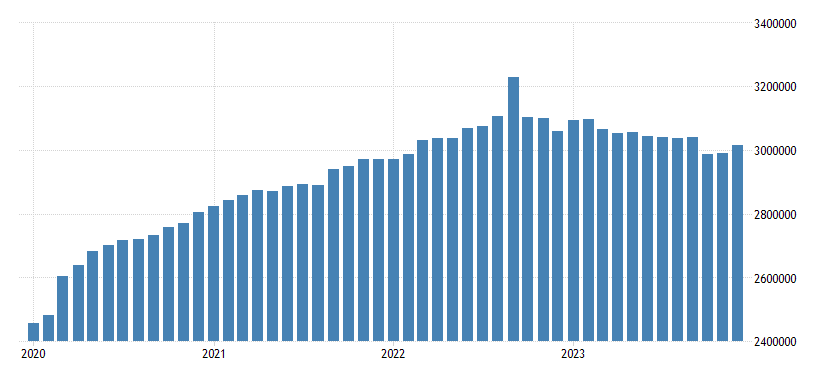

So – the money supply had been nicely falling, in a trend that looked to be coming back to something like the longer term trend line, which would have placated the monetarists in terms of inflation. However – there has been a recent resurgence. We are only two months into this resurgence – but before that, had had a fairly orderly downward trend in the money supply – which absolutely was too high – for 13 months on the spin. December’s reversal is significant and, of course, makes no headlines. There’s an argument that October and November were the false numbers in this sequence, when you look at the graph (included as today’s image) – and that would be fine – however, the resultant drop in inflation (which was massive in both of those months) would then surely be a potential victim of exactly that “false flag” mentality? Surely?

If that’s the case, the real world outcome is that real CPI could easily be well above 4%, perhaps closer to 5%, and – just like 2023 – not calm down as quickly as everyone is expecting.

Outcomes – if that’s correct? The hawks on the Bank of England Monetary Policy Committee (MPC) continue to vote upwards (more on this later) – and it takes longer for rates to come down. There’s a strong argument that at the meeting where the vote was 5 to hold, 4 to cut (September 2023) that we should have gone up then to 5.5%, taken the medicine, and the cuts could come quicker.

However – the backlash there would be – business insolvencies are up, big. That’s what the media tells us. However, this is a typical base effects scenario, and also cherrypicking of a world class order. Company insolvencies ARE up, and about 33% on the immediate pre lockdown market. Comparisons to 2022, 2021 and 2020 are basically useless. Individual insolvencies, however, are down about 20% on pre-lockdown figures. Bankruptcies are less than half what they were. The truth – as always – is not what is projected. The doves – and perhaps those who got fat on a low interest rate – have a vested interest in talking down the interest rate as quickly as possible.

You might think I would be in that camp. By rights I should be. But remember – I’m a weirdo. I can take myself and my personal interests out of this situation and talk about what I think is right, and needs to happen with the economy. At the moment, the interest rate needs to stay where it is – I feel that very strongly – and we should have gone to 5.5% in September 2023, and we should have made more effort from 2014 onwards to raise rates a small amount in a very orderly fashion. I await the analysis that holds Mark Carney’s feet to the fire because the outcome of the interest rate movements simply hasn’t been the meltdown that everyone predicted.

Every day that goes on sees the “soft landing” scenario where we return to normality – whatever that’s supposed to look like, anyway – without major fallout – creeps forward in probability. It still sounds idealistic to me, but the reality is that society is coping with all of this – in the now – and aside from the spectre of austerity as promised in the 2022 recovery Jeremy Hunt budget, coming to a town near you after the next election, we aren’t in anywhere near as bad shape as the doomsayers would like to make out.

The M2 money supply (my preferred metric of the 5+ that there are) was up 0.75% on the previous month. Perhaps that looks small in the scheme of things – but the expectations were a smaller rise, and the focus is on M4 which “only” moved up 0.5% compared to the 0.2% expected. That might sound like a fuss about nothing, but we are, as usual, talking in the billions of pounds here – and also trying to see what everyone else seems to be missing.

So – onto Nationwide, and their House Price Index. Always first to the party, as you know, to grab those headlines at the end of the month and the start of the new one. Another big upside surprise as they measured prices as moving up 0.7% month on month (no idea why this was a surprise – as said before, they use real time data from their own internal figures, and must have expected a massive surge in mortgage approvals since they led the best buy tables for most of the month!) – but of course, they are not the consensus forecast, just one of the forecasters. The 0.7% was against a backdrop of a 0.1% forecast, so a considerable miss, and the annual figure of -0.2% according to them is far nicer to see than the consensus forecast of -0.9%. We aren’t far off from year-on-year increases again, although whilst inflation rages on, real terms price cuts are nowhere near done yet for the housing market, if I’m right about inflation.

That draws us towards the end of the macro analysis, save our old friend, the bond and swap rates on the 5 year arrangements. We opened the week at 3.75% yield on the 5y gilt, and closed it at 3.79%. On the face of it – uneventful – but hold on. The rates tried to force lower, considerably, after the Bank of England meeting which was unexpected. The bounce then seemed to come the day after, even though the tensions are mounting in the middle east – again rates moving not as expected. This stuff can be hard to understand and even harder to predict – I definitely stick to the longer-term viewpoints here and whilst I check the rates more than I should, I tend to let it wash over me. We are basically still smack bang in the middle of my predicted range, and that’s that.

The swaps don’t seem to have updated from the close on Thursday night for those of us too tight to pay for Bloomberg or equivalent (I’m open to a sponsored account, if you guys are reading, which I’m sure you aren’t) – the Thursday night close was 3.56% compared to the 3.57% on the gilt, so I assume the Friday close would have been more like 3.80% or so. Still having that level of volatility – 0.25% in one day, not to be sniffed at.

That segues nicely into the Bank of England MPC meeting. Why was there so much volatility on interpretation in a “hold rates” situation? I’m so glad you asked, because there are a few reasons.

Firstly, to dwell for some time on the vote. On the YouTube channel there’s a full 10 minutes on the MPC themselves, particularly the hawks and the doves – those in the middle or in the balance get left alone. Getting down to brass tacks – I’ve said for a couple of months now that we can’t see a cut in base rates before we get that meeting where everyone agrees that rates should be held (or, most vote to hold and one or two vote to cut – a more likely scenario).

There were 2 changes in the voting direction of the 9 people on the committee so let’s focus on them and forget the rest. Both are “externals” – there are 4 externals on the MPC, and 5 who work for the Bank (comprising the Governor, 3 deputy Governors of different areas, and the chief economist). It was 2 externals who changed their positions.

The first was Dr Swati Dhingra. Dr D lost her partner in crime, Silvana Tenreyro, when Tenreyro’s term expired last year and she was replaced by Megan Greene. Dhingra is a notorious “dove” – one who believes that rates should be lower (as a rule) rather than higher, and is usually in favour of cutting in order to fuel economic expansion. Her defection from hold to cut is no surprise at all – there is, after all, an argument for a cut in terms of the trends in inflation in recent months, and also on the basis of the anecdotal evidence (which will come to pass at some point this year) in the job market in terms of hiring freezes and continued falling vacancies. If Tenreyro were still on the committee, I’d have expected her to vote “cut” here too – but she isn’t.

The other change was Megan Greene – Tenreyro’s replacement external committee member. Greene voted upwards to 5.5% last time, but to hold at 5.25% this time round. Without knowing too much more (insanely wonderful CV, but all the externals do – of course) – I can already identify with Ms Greene as closest to my own positions. Hold here was the right call. Raise is just too hawkish, and is not necessary, and would have too many wider implications.

So – with that inside knowledge – and the first down vote in some time, even if it was a very predictable one – we will now take a look at the minutes of the meeting in some more detail. I’ve done a line-by-line on the exec summary – when these tend to run into the entire meeting minutes – let alone the entire MPC report – they just get too long, I know! Let’s capture the Bank’s viewpoint of the most important parts of it all, and I have commented as I’ve gone along (in Bold for those reading, versus Italics for the Bank’s minutes, for listeners I’ve just changed my intonation when I’m reading the Bank’s summary):

The Bank of England’s Monetary Policy Committee (MPC) sets monetary policy to meet the 2% inflation target, and in a way that helps to sustain growth and employment. Yep, that’s their job.

At its meeting ending on 31 January 2024, the MPC voted by a majority of 6–3 to maintain Bank Rate at 5.25%. Two members preferred to increase Bank Rate by 0.25 percentage points, to 5.5%. One member preferred to reduce Bank Rate by 0.25 percentage points, to 5%. The 3-way split isn’t ideal. This is the second 3-way split in a couple of years. It gives fuel to the fire that the MPC hasn’t really known what they are doing throughout this entire process of “over-inflation” or misdiagnosis, or whatever you want to call it. Personally I think it shows a robust process, and how valuable it is to have an independent central bank. Annoyingly, it is almost always the externals that stick their neck out either way – whereas the internal members tend to vote with the Governor FAR too often for my liking, especially as I think the Governor is vastly underpowered to have such a big job – the Peter Principle in action.

The Committee’s updated projections for activity and inflation are set out in the accompanying February Monetary Policy Report. These are conditioned on a market-implied path for Bank Rate that declines from 5¼% to around 3¼% by the end of the forecast period, almost 1 percentage point lower on average than in the November Report. So, the end of the forecast period is 3 years hence, into January 2027. 3.25% is what the MARKET – the bond markets, over which the Bank has relatively limited influence and no control whatsoever – currently thinks rates will be in 3 years time – and this looks a pretty fair stab to be honest – as you might expect. One thing you can guarantee – some stuff is going to happen between now and January 2027.

Since the MPC’s previous meeting, global GDP growth has remained subdued, although activity continues to be stronger in the United States. Inflationary pressures are abating across the euro area and United States. The US core inflation is about 2% if you annualise the past 6 months. We aren’t there yet (still at 3% as per earlier in this week’s edition). Both the US and the Eurozone historically have lower inflation than the UK anyway, even all else being equal.

Wholesale energy prices have fallen significantly. Material risks remain from developments in the Middle East and from disruption to shipping through the Red Sea. Following recent weakness, GDP growth is expected to pick up gradually during the forecast period, in large part reflecting a waning drag on the rate of growth from past increases in Bank Rate. This makes sense. The change, now, is no longer a change – it is a hold for the past 4 months. After 6 months that effect is even lower, and continues to decay, like a half-life of a radioactive substance, for the next couple of years. Rates will be changing before that, though, of course.

Business surveys are consistent with an improving outlook for activity in the near term. The labour market has continued to ease, but remains tight by historical standards. In the February Report projections, the continuing relative weakness of demand, despite subdued supply growth by historical standards, leads a margin of economic slack to emerge during the first half of the forecast period. Unemployment is expected to rise somewhat further. It is hard to find anyone who disagrees with the fact that unemployment will rise – however, it is always worth putting it into context – anything below 6% was historically considered fantastic, and below 5% let alone below 4.5% is very tight indeed for the labour market. This leads to lower productivity and/or higher immigration.

Twelve-month CPI inflation fell to 4.0% in December 2023, below expectations in the November Report. This downside news has been broad-based, reflecting lower fuel, core goods and services price inflation. Although still elevated, wage growth has eased across a number of measures and is projected to decline further in coming quarters. This feels more than a little understated. Wage growth has eased a bit, but is still stubbornly high, with the April rises in benefits and National Minimum Wage already enshrined, and benchmarking rises all around and about. I’m not on board with this forecast being much more than just drawing a line based on the trend for the past 6 months. I think we should be doing better than that.

CPI inflation is projected to fall temporarily to the 2% target in 2024 Q2 before increasing again in Q3 and Q4. This is because the “base effects” of the worst part of the inflationary cycle drop off until April has come and gone – and then of couse the April wage rises will percolate through into spending/consumption, and drive inflation forward again if my predictions are correct.

This profile of inflation over the second half of the year is accounted for by developments in the direct energy price contribution to 12-month inflation, which becomes less negative. So, basically, energy went up a lot, and it has come back down a lot, but not quite to where it was – so, the down side of that cycle has now happened and been factored in, and the likely path now is upwards again, but slowly (perhaps not in 2024, but in the medium term).

In the MPC’s latest most likely, or modal, projection conditioned on the lower market-implied path for Bank Rate, CPI inflation is around 2¾% by the end of this year. So – the bank are on the bus that it takes time for inflation to come down – FINALLY. I wouldn’t be surprised if CPI was 3-3.5% at the end of this year, personally. Murphy’s law suggests that now inflation WILL drop significantly and do what Capital Economics are saying instead – but it is only Murphy that I’ve seen agree with Capital Economics so far, not anyone else.

It then remains above target over nearly all of the remainder of the forecast period. So, basically, the Bank is saying that inflation will be above 2% for most of the next 3 years – and this is OK, because at the end of the forecast period it is back down to 2%. I’m in agreement with this as a rule, because any intelligent government (really) will want inflation in that 2-3% range, if not 3-4% range, simply to eat that fiscal drag and up those tax revenues using the frozen thresholds for income tax (and everything else).

This reflects the persistence of domestic inflationary pressures, despite an increasing degree of slack in the economy. CPI inflation is projected to be 2.3% in two years’ time and 1.9% in three years. Wouldn’t take too much stock in that level of accuracy given the time before we get there.

The Committee judges that the risks around its modal CPI inflation projection are skewed to the upside over the first half of the forecast period, stemming from geopolitical factors. In plain English, more war that we are anywhere near involved in or affected by will put prices up more, not down more.

It now judges that the risks from domestic price and wage pressures are more evenly balanced, meaning that, unlike in previous forecasts, there is no difference between the MPC’s modal and mean projections at the two and three-year horizons. Conditioned on the alternative assumption of constant interest rates at 5.25%, the path for CPI inflation is significantly lower than in the Committee’s modal projection conditioned on the declining path of market rates, falling below the 2% target from 2025 Q4 onwards. This is interesting. Their models show that if they held interest rates up here for 2 years (and that would be more damaging, certainly to business and stocks) then it would STILL take nearly 2 years to get inflation back to target in a stable fashion. Wow! It’s a slightly technical point because that won’t be happening – but nonetheless…….

The MPC’s remit is clear that the inflation target applies at all times, reflecting the primacy of price stability in the UK monetary policy framework. The framework recognises that there will be occasions when inflation will depart from the target as a result of shocks and disturbances. Monetary policy will ensure that CPI inflation returns to the 2% target sustainably in the medium term. But, as above, can stay above that target for another 3 years, effectively. Go figure. That’s some target.

At this meeting, the Committee voted to maintain Bank Rate at 5.25%. Headline CPI inflation has fallen back relatively sharply. The restrictive stance of monetary policy is weighing on activity in the real economy and is leading to a looser labour market. In the Committee’s February forecast, the risks to inflation are more balanced. Although services price inflation and wage growth have fallen by somewhat more than expected, key indicators of inflation persistence remain elevated. As a result, monetary policy will need to remain restrictive for sufficiently long to return inflation to the 2% target sustainably in the medium term in line with the MPC’s remit. The Committee has judged since last autumn that monetary policy needs to be restrictive for an extended period of time until the risk of inflation becoming embedded above the 2% target dissipates. Mostly a summary of what’s already been said – all I will say here is a point I’ve made before, and above – by not going to 5.5% last year, it costs us all more time (and in the long run, more money) because it takes much longer to be able to cut confidently. Remember, though, if you asked Dr D she’d say we are running a risk of overtightening here, and there are some who agree with her (mostly down to vested interests, from what I can see!).

The MPC remains prepared to adjust monetary policy as warranted by economic data to return inflation to the 2% target sustainably. It will therefore continue to monitor closely indications of persistent inflationary pressures and resilience in the economy as a whole, including a range of measures of the underlying tightness of labour market conditions, wage growth and services price inflation. On that basis, the Committee will keep under review for how long Bank Rate should be maintained at its current level. Well, good, because that’s the job. Does sound a bit like an excuse for not doing a fat lot for a few months. I’d throw my hat in the ring for that at £158k a year as an external – in fact, tell you what – I’ll do it for £157k (saving the public purse money once again).

Congratulations as always for getting to the end – don’t forget the Property Business Workshop on Wednesday 24th April – tickets for you, or anyone you know who might want one, here: https://bit.ly/pbwtwo . Onwards, upwards, and we leap into February – Keep Calm and Carry On!

Adam Lawrence