““The creation of a thousand forests is in one acorn.” – Ralph Waldo Emerson, American Essayist.

Before we begin – the Propenomix YouTube has a couple of new pieces of content to just let everyone know about. Firstly, I am ensuring that one piece of content goes on the channel every day in 2024! That’s a big undertaking, although some will only be very short videos. I will be releasing a “Macro Blast” for those who want to keep abreast of some of the pieces of news that make the economy tick. I will also be releasing a video in my new series which I have called my “Four Pillars of Investment” – a strategic framework that I first came up with back in 2016, which should have relevance to anyone who has a property business or is seeking to take property seriously – from 1 property to 1000+. If you do watch, please make sure to like, subscribe and drop me a comment – it all helps out the channel a lot. Thanks in advance!

After this we will be 2 Supplements down for 2024, with 50 to go – even though it is a leap year. When you are really lucky, there are 53 Supplements in a year – I’ll leave that one for you to think about. Fairly soon the “New Year” feeling will be forgotten – the internet is full of lies, damned lies and statistics about how long resolutions last, as I’m sure you know – but let’s make the most of it while we have it. Whilst the boundary to each year is effectively arbitrary, utilising anything that gives you and the people around you an extra bit of pep in the step has to be a smart move. Keeping the fire burning is always the challenge. I always feel January is the craziest month to ever try and be extra disciplined – it’s dark, miserable, long and cold, and often wet or snowy – no wonder those resolutions don’t last! But there we go, shall we try some resolutions at Easter? Not sure it will take off.

The macro isn’t incredibly detailed this week – although there’s been moves of interest – but I’m using the rare bit of breathing space to share some extra interesting snippets that I’ve been reading from the Bank of England. The transparency has to be credited – although there is a risk of setting conspiracy theory hares running – you won’t hear about those in the Supplement, but there’s always an upside and a downside risk to anything that’s made public from important, large public institutions.

So let’s tuck in to that macro. 16 metrics of interest or macro events that are widely publicised that occurred this week – and once again, I’m going to narrow the scope somewhat – to the “deemed important ones” as the market dictates, and also the ones that I think are both interesting and important in building that ongoing picture of understanding the UK economy as it relates to property investors and developers.

I’m kicking off this week with one that – again – doesn’t get a lot of column inches, or whatever you call the equivalent in audible terms. Words, I suppose……or seconds? Anyway – that’s the BBA mortgage rate – the “reversion” rate, lenders standard variable rate (SVR) or whatever you prefer to call it – reported by the Bank of England, monthly. We had a peak at 8.05% in October 2023, and had been flat really in November, but we are down until that massive 8% milestone to 7.96% which was a shade under consensus – mostly because the bond yields had dropped faster than expected in December.

Perspective is always good – a couple of years ago this was in the 3.6% region – although the post-financial crisis number would be more accurately measured at an average of roughly 4.5%, before we get too excited. What will it take to move this number down? Quite a bit, but the direction is definitely downwards simply because the short end of the yield curve is sloping downwards. As the 3-month gilt yield comes down, this number will trend downwards – a “best-guess” for the end of 2024 sees it at around 7%, which is still eye-watering for those holding stock on variable rates.

It will be a cold day in hell before the bond yields and swap rates don’t get a mention in the macro metrics section. The 5-year gilt traded in a tight range, opening at 3.68% on Monday morning and closing at 3.55% on Friday afternoon. The more interesting analysis is what this means in the face of a week where the news, by right, should have meant higher yields (arguably). Why? Because, when the economy is appearing to do a little better than expected, interest rates would be expected to stay higher for longer. What took over, instead? Fighter jets, oil prices and Houthi rebels did – conflict drives bond yields down (because money flocks to the safety of the bond market) – even though it also drives inflation upwards, especially when it is in the Middle East or directly involves securing the passage of goods and cargo ships (including oil, of course) through the Red Sea. The Suez canal is so viable because it is an awfully long way around otherwise – and container prices are up from $1000 for a 40ft container to $4,400 relatively quickly – although they were $15,000 at the Covid peak.

The (relatively uninformed) opinion, remember, is that when a geopolitical event of aggression breaks out, that the economy of countries involved will suffer. That’s usually incorrect – IF the UK, for example, had to spend more money on defence at any point in the near future, and needed to borrow to do it – the GDP of the UK would actually increase. My takeaway from this week is that the events in the Red Sea have been deemed to be more important than what happened with the GDP figures for the UK that were also released this week.

Those figures for GDP were – a 0.3% increase in GDP for November, versus a consensus of 0.2% growth. Just ahead of the game – you wouldn’t expect a major shift here anyway. The 3-month rolling number however moved to -0.2%, mostly still reeling from a -0.3% event in October, leaving the possibility of a technical recession (2 consecutive quarters of negative growth) as a reasonably high one. NIESR (who produce flash estimates) have December growth leading to a quarterly GDP figure of 0.0%, which would avoid the technical recession by a hair’s breadth.

As I’ve been saying for a year now, whilst the “R word” is important, the difference here is absolutely at the margin. Either we will have shrunk by 0.2% in 6 months in real terms, or else we will have shrunk by 0.1% in 6 months in real terms, unless we get a real upside surprise for December (December’s inflation number is the first step, of course – if the Xmas sales were aggressive, then this would have an impact as would the services industry having a slower month in December, typically). We will see. It is pretty much all psychological here, though.

The consensus (which I agree with) is that we will see a return to growth in Q1 2024, and that will either stop a recession or calm us down a little. However, this constant commentary that inflation will now – in the UK – come under control, as a country that tends to “run hotter” than the Eurozone and the US, when neither of those are truly under control (indeed the US printed a surprise move upwards in inflation for December, up to 3.4% on the overly-reported CPI, but with core still at 3.9% – no real substantive move downwards for 7 inflation prints in a row now, in the US) – seems laughable to me. We have taken the low hanging fruit of cheaper petrol and food inflation reversing – once those are over, if services inflation is still running hot, we are heading for more of the same, stuck around the 3.5% to 4% mark.

I’m largely out on my own in this view, but I’m happy there. Many commentators I respect are saying inflation will be 2% by April – and I’ll be the first who is happy to be wrong – but I’m not having it. I’ve marked the card here – and will be accountable for it.

That only leaves the final metric worth a mention. Construction output. Year on year it has increased 0.9% (so it has been hammered by inflation, realistically) – nowhere near as bad as some of the bearish forecasts, but obviously a real terms contraction. November’s figures were also weaker than hoped because of some storms and extreme weather events – that really don’t seem so extreme any more.

On the subject of weather – I listened to one interview of particular interest this week – with the economist Steve Keen. The point that really made my ears prick up was around climate change – Keen was keen (sorry) to point out that economists are very poor in general when discussing climate change because they tend to only look at temperature changes (which can be argued to be a net positive) and not precipitation increases (which are universally accepted to have a negative impact on global food production, according to Keen). I haven’t heard the argument formalised in this way before, and I just thought I’d mention it here as an “aside of interest” as the rainfall around the UK.

The Met Office look to be on the same track as Keen has outlined, because they focus on the fact that 2023 was the second warmest year on average ever for the UK (which has to be considered significant – of course – and the record year was 2022, so that speaks to a seriously significant trend) and then well below the fold, they discuss the rainfall side of things. The rainfall was, in fact, 11% above average – although a lot of the storms would be lost in the averages, of course. There was 48% more rainfall than average in December – where the storms show a little more clearly.

I want and need to look at this in more detail in the coming weeks and months. I do have (particularly long-term) concerns over expanding flood risk areas, but these numbers do seem to have significant outliers in them. However – what averages conceal, alongside many other things, is the concept that at the extremes (such as a storm) things get MUCH worse quite quickly (only a hypothesis at the moment), while the averages don’t move too much at all. This isn’t mentioned in the Met Office review of the year, unfortunately.

That ties up the macro and leaves me to steam into my soapbox topic of the week! The Bank of England Overground. No – it isn’t what the Bank’s workers do when there is a tube strike. The Bank publish some of their research work which is informing internal conversations at the Bank on a regular basis. Well – actually – it is an irregular basis. I’m grateful they are doing it but here are the 2023 release dates in order:

20 Jan 23

20 Jan 23

22 Feb 23

27 Feb 23

04 Aug 23 (eh?)

08 Aug 23

22 Aug 23

25 Aug 23

12 Sep 23

15 Dec 23

You’d be forgiven for thinking that the employee in charge of the blog either changed in March 2023, or left the Bank – August is a great month to catch up while everyone is on holiday (or to slip out some “interesting” news and largely remain unnoticed, sorry for being so cynical) – and then the “new wave” died off before one was published on the last relevant day of the working year for the Bank.

Anyway – I remain grateful for the insight. I referenced the 12th September piece in my New Year’s Eve Supplement, since it was the precursor to their larger report on Buy-to-Let and financial stability which was published in December. Here’s the exec summary in the Bank’s own words regarding their December blog entry:

“Our latest survey of British household finances shows that mortgagors are adjusting their behaviour to both actual and anticipated increases in mortgage payments. The latter suggests that the aggregate reduction in spending may materialise faster than the rise in mortgage costs.”

This is very textbook-economics speak, for those who don’t know. The theory of “rational expectations” – logically, if you have a mortgage you’d have to be hiding under a rock not to know that interest rates have been going up. People are therefore being “proactively reactive” is the way that the Bank is laying it out. Let’s take a closer look.

The research question here is: “How are households adjusting to rising mortgage costs?” The thinking is that increased costs “may” reduce household spending on other goods (for it not to, households either need more income, to borrow to maintain levels of spending, or a bit of both). This is the Bank making further enquiries using surveys – we’d rather see a study based on actual measurements and actions, rather than what might well be intentions that are not followed through; but this is what we’ve got.

The most recent survey was carried out between 30th August and 19th September 2023 (this stuff is just never up to date – this is as good as it gets, frustratingly). 40% of mortgagors reported an increase in their rates in the past 12 months (which seems much higher than suggested in other surveys, but must include – all on variable rates, half of the people on 2-year deals (roughly), and 20% of the people on 5-year deals – other terms are available of course, but that’s just a rough average).

The “big” finding here is that for every £100 increase in mortgage payments, on average the households surveyed cut spending by £50. As above, they either had to bridge the gap by earning more, or saving less/borrowing/dissaving.

That’s for those (the 40%) who have already faced the increase. For those who are now expecting the increase, they cut their spending by £28 for every expected £100 rise – and are looking to increase that to £37 in the year when the rise is actually coming.

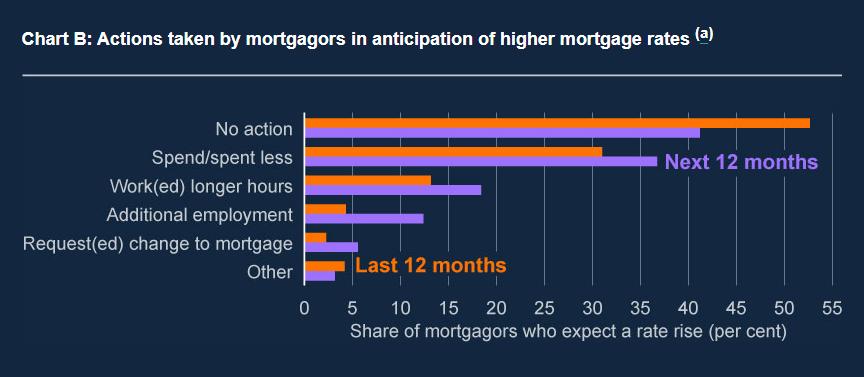

This week’s graph shows what people have actually done in the face of the higher payments, and then what they intend to do in the expectation of them. I would MUCH rather concentrate on what they actually did, rather than what they say they are going to do.

Context is always important. At the point of the data collection, the 5-year gilt yields were around 4.3% on average. This compares to today’s 3.55% – so, by proxy, the 5-year interest rate should be around 3 quarters of one percent lower than it was when this survey was taken. Also – the 2 year is down from c. 4.8% average when the survey was taken to 4.16% today (so 0.65% cheaper, ish). At the very least, this means less sacrifice of course.

About 53% of people took no action at all on the basis that payments had gone up (well, presumably, the action that they took is that they just paid them). What this means is that they didn’t change their behaviour. 31% spent less. 13% worked longer hours. 4% got an additional job. 2% requested a change to their mortgage (presumably longer terms, or interest only periods perhaps). 4% did something else. On those numbers, about 7% of people took more than one action.

Unsurprisingly, the closer the mortgage dropoff date was, the more (as a percentage) of people took action. However, perhaps surprisingly, even those who had a rate lasting until 2027 took action 38% of the time. That’s significant – and perhaps speaks to just how worried people were.

We have to wait until September-ish 2024 for this survey to be repeated, and then wait a bit longer for results to be released after analysis at the Bank. The current market would suggest we could do with something more regular, more cross-sectional, and more “real time” – but nothing seems to be forthcoming.

I look forward to anticipating the Bank’s next big “beefs” or bees in their respective bonnets by keeping an eye on the Bank Overground information – but can’t say with regularity when something of interest will next be published.

I’ll leave you for this week with a final thought – Rightmove’s 3 predictions for 2024:

- Landlords will have to balance priorities to get the price right – referring to affordability

- Landlords may delay green improvements in the face of the Renters Reform Bill (although this just looks like a reaction to Sunak scrapping the EPC C targets)

- The rental market will remain under pressure thanks to stretched affordability to buy.

Not particularly bullish (nor the biggest 3 issues in the sector, although the RRB in general is big news, no two ways about it). Still – the most respected voice in the industry on the sales side, the near-monopoly – so, rightly or wrongly, people will listen.

Congratulations as always for getting to the end – don’t forget the new “Four Pillars” video series on the Propenomix YouTube. Subscribers are very, very welcome, and here are the links – for the channel: https://www.youtube.com/channel/UCpNyNRdTJF87K3rUXEV3s-Q and here to the Propenomix website: https://propenomix.com/ – thanks for supporting me spreading the word, more subscribers will lead to more and better content. You know the one remaining sentence – Keep Calm and Carry On!

Adam Lawrence