“Cheers to a new year and another chance for us to get it right.” – Oprah Winfrey, American host and tv producer.

Before we begin – the Propenomix YouTube has a couple of new pieces of content to just let everyone know about. Firstly, I am ensuring that one piece of content goes on the channel every day in 2024! That’s a big undertaking, although some will only be very short videos. I will be releasing a “Macro Blast” for those who want to keep abreast of some of the pieces of news that make the economy tick. I will also be releasing a video in my new series which I have called my “Four Pillars of Investment” – a strategic framework that I first came up with back in 2016, which should have relevance to anyone who has a property business or is seeking to take property seriously – from 1 property to 1000+. If you do watch, please make sure to like, subscribe and drop me a comment – it all helps out the channel a lot. Thanks in advance!

Welcome to the first Supplement for 2024. I’d like to say not a lot has changed in a week – and in a week with only 4 working days, you’d think that was the truth – but it isn’t, really. I want to get into the macro items of relevance for this week, and then want to press on with a slightly different look at the housing situation, the rental market, and the big picture to start 2024 off on a strategic footing.

The Composite PMI puts together the Services PMI with the Manufacturing PMI in the appropriate proportion in terms of what they contribute to GDP – and was up overall because of Services’ far bigger share of economic output. The print was 52.1 up from 50.7 last month – and again, well ahead of forecasts. Pretty bullish stuff, even with a struggling manufacturing sector that suffered much more from inflation than the services sector has done.

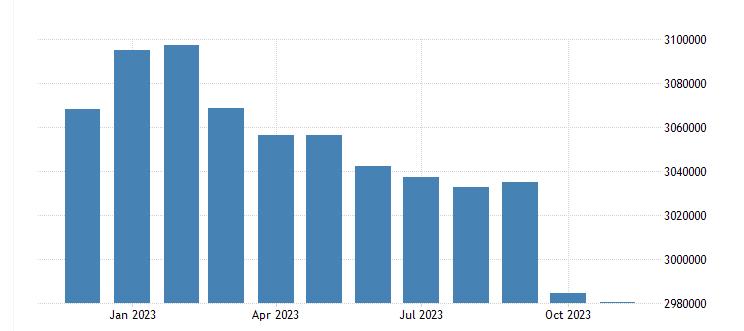

So far – limited evidence that price rises can’t continue and that wage rises won’t just carry on being passed on. Always remember – services inflation is 47% of CPI – basically half. Next up is the money supply. I don’t spend a long time talking about the money supply on Propenomix, although it is quite a controversial metric. It doesn’t really get the airtime it deserves generally, and is seen as “less than important”. However, there’s a fair correlation between an expanding money supply and inflation – in a nutshell, the monetarists (those who follow Hayek and Friedman – the latter of which I’m particularly a fan of, although I have feet in both camps) strongly believed in the correlation between expansion of the money supply and inflation – probably too much. Keynes’ explanation – as the father of the rival Keynesian school – would rather classify inflation as “cost-push” and “demand-pull” and would have rated the recent bout of inflation as very much “cost-push”, at least to start with – although the whole problem in a nutshell was that demand just did not collapse as it was expected to back at the peak of the first lockdowns, in April/May 2020. The money supply certainly expanded – as many will know – but might not know that the money supply (I prefer M2 as the relevant measure, although there are at least 4 other alternatives) is down around 7.5% from its mid-2022 peak, which wasn’t far off where inflation peaked, the eagle eyed will notice.

The inflation peak of course also tessellated quite nicely with when the majority of the cost-push inflation peaked, so it hasn’t proven too much – although the monetarists would point out that they knew inflation was coming as soon as the stimulus started in Q2 2020 – and of course, that bit was right (or certainly correlated). This is why I prefer a foot in both camps. The main point, though, would be that the trend has been downwards for over a year now – but we are still well above the long-term trend line – by around about 10%, although inflation has obviously had a stronger impact than that (the trend line is upwards, so the two things are not directly comparable – the money supply is around about 22% higher than it was on 1-1-2020, which is freakishly close to what inflation has been (depending on your preferred measure!) since then, which is what gives the monetarist argument so much credence. The important takeaway is that the current movement is sideways and a bit downwards – typical in a hiking cycle – and watching the money supply is a good idea for clues about the future of the economy and inflation.

Onto Halifax, and let me prepare the soapbox for this one. I was pleased to see a positive print for December – let me remind everyone that Halifax and Nationwide tend to provide a more “real term” picture of the market, using data about mortgages being offered in December (and valuations undertaken), whereas the ONS measures transactions completed in the month (and runs a couple of months behind). The conventional wisdom is that the ONS tends to lag the Halifax/Nationwide by about 6 months, although they are more divergent than that. Whilst Halifax/HBOS and Nationwide are both “big 7” lenders, the ONS has all the data – so you have to trust the ONS above all for accuracy.

Halifax reported a 1.1% rise (expectations were 0.1%) for a third consecutive price rise, and a 1.7% rise for the year since December 2022. They continued to be bearish however (in spite of recent drops in bond yields and rate expectations for 2024) and forecasted a 4% drop for 2024. This struck me as unnecessarily bearish, especially as I have forecasted a 3-5% price rise based on the most recent figures, although after the bond yields this week I feel that the bottom end of that forecast might be more accurate (but what’s a week, there’s 51 left…..right!)

So – off down the rabbit hole I went. What did Halifax predict for 2023 at the same time last year? And what commentary was there around that? Turns out they were roughly in the middle of the bearish forecasts, and predicted an 8% drop in 2023 in housing. So – 9.7% out on their own index. Direction completely wrong. Did they mention that? No. Not at all. And they aren’t alone here – precisely zero of the big forecasters EVER hold themselves accountable. They are simply throwaway numbers that are almost never right, and that – in my view – is pretty rubbish.

They have the ear of many and this is the opposite of the positive reinforcement I was talking about earlier. It’s also REALLY not very good for business, you would think – so it really beggars belief. It’s just Halifax’s turn to take my ire – you could direct the same at the majority of the rest – if it was worth me going back 12 months to look at all the forecasts, I’d do that. If any keen readers want to compile the forecasts from the major banks, building societies and industry titans for 2024, based on what they are saying today, then I’m very happy to take them apart (or praise them, and lambast myself – because I don’t just walk away from my forecasts) when we get to the end of this year!

One more macro-level event – this week, there was a 15-year gilt issued and I was surprised to see it sold at above 4% yield. This still screams good value to me, although I am not a bond trader, and this is not financial advice of course. There’s murmurs and problems in the Suez canal (although 0.3% of global GDP comes through the Suez – that’s how little impact it really has) – but compare this to before Xmas, when all the news was bearish for the UK economy – all the news this week has instead been either bullish, or bullish for inflation. That’s why the bond yields opened the week (shortened week as well, only 4 days trading) at 3.31% yield and closed it at 3.64% yield. 33 basis points “against us” as borrowers.

So what, I hear you cry (sometimes) – well, this offers a pretty good opportunity in my eyes. The “so what” is that you should get any refinancing applications in in the early part of the coming week. The rates have been adjusted and are being released Monday after the Xmas break is “really” over, and they reflect the 65 basis points lopped off the gilt before Xmas, and NOT the 33 points back on in this past week. Take those rates now.

I felt and said near the end of last year that I couldn’t really see the 5-year trading below 3.5% in much of 2024, black swans aside. It then went on to prove me wrong before we even got to 2024, by going much lower and closing the year around the 3.3% mark. However, I feel 3.5% – 4% is more realistic and even if the swap margin is very tight indeed, that still sees the cost of debt around 5.5%-6% (remember, rates will be lower but that gap will be plugged by fees). The 5.3% (equivalent) that’s around for the next week or two (IF there isn’t more significant volatility) is therefore pretty good value in my eyes.

The likelihood of the 6 rate cuts in 2024 theorised by the market in the last week or so has moved downwards considerably. If the PMIs ARE accurate enough, then its likely we will get more bullish economic data than bearish in the near future, and therefore rates “can afford” to stay higher for longer. There’s also one more phenomenon that it is worth pointing out, that no-one (that I’ve seen so far, anyway) saw coming.

The bones of it are this: People had investments that were not fixed income when 2020/21 was offering returns on fixed income (bonds) of basically zero. They did OK, mostly because debt was very cheap. Suddenly, the environment changed. The larger corporates (and the Supplement readers) fixed their debt in early/mid-2022 at healthy rates. As the rates were hiked again and again, suddenly fixed income became better value than it had been for a generation. When the 30-year gilt (and please, be aware, I cannot explain the shape of the yield curve at the moment in a way that makes sense to me once you go beyond about 10 years – if any readers or listeners can, I’d love you to do that for me!) touched around 5.25% late last year, that looked like incredible value. Pension funds and institutions will have absolutely loaded up – it also made other investments (like build-to-rent, for example) look far, far less attractive than they were in 2020/21.

These sudden (or relatively sudden) increases for income meant that those with savings suddenly had an income windfall – whereas those with debt (on average) were protected by fixed rates. Debt was fixed, sometimes for really long terms – savings were not, and rode the wave upwards of the floating rate (they then may well have fixed, if they are sensible). So – the net effect of the interest rate rise was actually to CREATE value and the windfall – for the moment – has outweighed the pain. Interest rate rises have been a net POSITIVE for the economy.

This is one small reason why the economy has been more robust than many expected. However – buckle up. This isn’t an ongoing feature – and as fixed debt starts to drop off, that “fiscal drag” – the same drag created by freezing the tax thresholds until 2029 (yes, that’s really the current plan – OUCH) – will kick in and start to hurt the economy more.

This is one factor that really has been very different from previous hiking cycles. However, calling the highly-desirable “soft landing” on this basis would be a mistake. I say again, 3 of the 9 members of the Monetary Policy Committee still voted to raise the base rate again at the last Bank of England meeting in Mid-December 2023. We at least need them to vote to hold before we get to a rate cut scenario for sure. There’s still plenty of time for this to play out. We’ve also (as I’ve said before) got some inflationary events coming, including an election giveaway tax cut coming in Spring without a doubt, and some massive rises in pensions, index-linked benefits and minimum wages in April ‘24. Better economic signals plus inflationary (or certainly NOT disinflationary) policy wouldn’t make me want to put rates down, as a Central Banker (actually – I would be voting down, but that’s because I am struck by the argument that changes take at least 6 months to kick in, and I do think in 6 months we will wish we had started cutting rates earlier – but I don’t think the MPC will agree with me).

That’s the macro “wrapped up” – another rollercoaster awaits us, and hopefully these weeks of considerable swings will be behind us at some point, but consistent economic data seems to elude us at this time – and in honesty, a lot of the big players really don’t know what to think. I still feel base rate 4.25% at the end of 2024 is a decent punt at this stage, but that’s what it is – a punt.

I want to finish this week with a question – rather than a second thesis, or some further deep dive into the data. This shouldn’t be controversial, but could be made to be so if clickbaiters wanted. The subject – immigration, and specifically the impact on the rental market.

Here’s the rough scenario in the past 24 months or so. 1,279,000 (ONS figures) net migrants into the country. I referenced Richard Donnell from Zoopla’s recent newsletter which touched on this, in which he made an educated guess that around 90% of migrants would go into the rental market (we’d have to also consider – would most of those leaving the UK also be renters? Or would more of them be owners – I’d suspect they might be – but nonetheless, ignore that for the moment). Let’s stick with the 90%, and only consider the net figure.

That means 1,151,100 new tenants. The average household (according to the Bank of England paper I dissected last week) in the rental sector is 1.25 people. That seemed low to me, but let’s go with it (and it makes sense for economic migrants travelling alone, and also for students, etc.). That’s a requirement for 920,880 new rental units.

We could pick all sorts of figures for this next part – but I’m going to stick with what I think we know. There are – net – no net new rental units in the UK over this 24 month period. BTL hasn’t stacked up. The takeup of BTL mortgages has been woefully low as a percentage of new mortgage business, and all landlord surveys talk about more sales than purchases, both in terms of intentions and in actions. The data is weak here – but I’m happy to defend that.

We’d then have to switch to voids. Historically the sector has carried between 300k and 500k voids from aggregated agent data (plus extrapolation to include those who manage without agents). With a PRS at around 4.6 million units, the top end of that looks high (more than 10%) – but recent estimates have had voids running at more like 200-250k (which feels more accurate – around 5%. We also don’t know how many of those would be under refurbishment, but of course it would be a non-zero number – 1% would likely be an underestimate of the entire stock under refurbishment and thus not lettable).

Even if we are as generous as possible, let’s say that in the past 2 years there’s been 200k voids that are now basically permanently filled. We still need to find another 720,880 rental units. This is the BEST case scenario.

Well – how the chuffing hell do we do that then? Let’s consider the one true secret weapon – HMO. There MUST be more HMOs – right? The only figures that seem to be widely used are those from Octane Capital – which need a refresh, but suggest a sector that has shed around 30k HMOs in that same time frame. That might not be 150k rooms (or whatever the average might be – likely a bit larger than that) – I would also wager this data is not counting unlicensed HMOs, which might be on the rise. Can we be as bullish as possible, and suggest that 100,000 new HMO rooms have been created over this time period? That seems so hopeful. That still leaves us with 640,880 rental units to find (remember we are using 1.25 people per unit as our yardstick).

In case you haven’t noticed, we are running out of answers. What’s left? Well, some of the net migration will be on the basis of asylum “backlog” cleared in 2023. By all accounts, around 70,000 cases net have been solved in 2023, with the vast majority leading to an acceptance. Let’s say 50,000 were accepted (that’s likely bearish). On acceptance, the successful applicants are given 7 days to find permanent accommodation, no longer on the responsibility list of the Home Office after that.

Stop right there. Really? 7 days, I hear you say? Yep – that’s right. I’d contend that you or I would struggle to get a tenancy from a third party in 7 days – and you’d hope that we’d know what we are doing. But that’s the number. What, therefore, happens to the majority of those people? I’d wager they then become the local authority’s problem – present as homeless, and go from a hotel seeking asylum (or a SERCO, or similar, property) and become a temporary accommodation statistic. From hotel to B and B, I’d imagine – I’d bet diamonds that that’s the typical path.

Seems like a bad joke, doesn’t it? Still, that’s not taken anything away from our rental units – although they have to be somewhere, as do the rest of our 640,880 x 1.25 people that we haven’t housed yet.

We really are at the bottom of the barrel now. Where ARE these people? Well, I have one theory left. Over-occupying other properties. The largest insight we had in recent years to over-occupation was the tragedy in the Grenfell Tower in 2017. Many tales of 7 people living in a 2-bedroom flat. The situation simply can’t have gotten better since then.

I’m now going to quote directly from Hansard from a debate in the House of Lords at the end of November 2022. This is symptomatic of the problem – the real-time data just isn’t there, and so we end up using educated guesswork. This refers back to the English Housing Survey in 2020-21 that I’ve referred to before, with answers coming from January 2021 – a massive three years ago now.

“Overcrowding was more prevalent in the rented sectors than for owner-occupiers. In 2020–21, 1% of owner-occupiers (172,000 households) were overcrowded compared with 8% of social renters (316,000) and 6% of private renters (250,000). Overcrowding was more prevalent in the social rented sector than in the private rented sector.”

I’ll fire one more bullet before I tell you that overcrowding has moved from 566,000 (combined social and PRS) to more than a million in early 2024, although I wouldn’t be at all surprised if it had. There may well be more temporary accommodation (by, for example, lowering the stock of hotel rooms, or repurposing buildings for profit) than there has been because people have made big money from renting floors or entire hotels (or goodness knows what else) to SERCO et. al, or the Home Office themself.

The central point, though, is really two-fold. One – these people are somewhere, but who can answer where? Anyone who can add anything to the above is most welcomed! I have left out PBSA (purpose-built student accommodation) because many migrants are of course students, although the most recent figure for PBSA growth was 1.5% year-on-year – something, but less than 100k units by some chalk. Two – the “lower” net migration expected for 2024 is likely to come down to – what? We’d have to predict a range – and a wide one. Between 350,000 and 500,000? Given recent numbers (but also recent events that have increased migration more than ever?) Where will those people go?

This isn’t a call for gunmen on the borders, sinking small boats, or buying every dinghy in Europe (yes, some doughnut did actually call LBC’s Nick Ferrari last year and suggest exactly that – buy all the dinghies, that’ll stop em!). It is merely an attempt to measure the incredible strain on the PRS at this time, and so that you can put into context when and whether this incredible excess demand is likely to continue, stop, or increase even more. You can tell where my money is right now – increasing even more.

It is a sad world when the best we can likely hope for is to profit (or at least to ensure continued financial viability of our property businesses) from a situation like this – BUT this is a commercial case, meant to be bullish – unlike some of the idiot forecasters who constantly forecast, incorrectly, economic meltdowns and house price crashes. I’m absolutely sick of them, and sick of no-one ever calling them out successfully. They were RUBBISH in 2023 – absolutely abject – and look no better at all in 2024. Also – they aren’t sorry. They aren’t embarrassed. They should be those and more, in my view. Onwards and upwards should be the rallying cry to the PRS and the private investors – not “run and hide!”.

Of course – good for you for getting this far. Many won’t have done. This is where edge comes from, and that’s what I try to do in the Supplement. Put forward my own thoughts, and gain edge which I can then share. Think it through. Debate it. Refine it. Go again. USE it in my day to day property group. That’s where I’m at – that’s where I’ve always been at – and that’s where I will always be at. Thanks for reading, and I look forward to a better 2024, trying to be a better version of myself tomorrow than I am today. The rest I spend zero time worrying about, and I’d strongly recommend you do the same. Happy New Year!

Congratulations as always for getting to the end – don’t forget the new “Four Pillars” video series on the Propenomix YouTube. Subscribers are very, very welcome, and here are the links – for the channel: https://www.youtube.com/channel/UCpNyNRdTJF87K3rUXEV3s-Q and here to the Propenomix website: https://propenomix.com/ – thanks for supporting me spreading the word, more subscribers will lead to more and better content. We start 2024 the same way we finished 2023 – we Keep Calm and Carry On!

Adam Lawrence